Transform your website – plugins that simplify online student bank account opening

The digital banking landscape is witnessing an unprecedented surge. By the year 2024, the number of online banking users is projected to skyrocket to a staggering 2.5518 billion, marking an increase of over 648 million in just four years. These numbers highlight an urgent need for banks and financial institutions to adapt and streamline their processes for the digital age.

Particularly in student bank account opening, quick and effortless online functionality is no longer a luxury but a necessity. Enter the transformative power of website plugins. When incorporated strategically, these tools can transform a website into a seamless platform for online student bank account opening.

Read on as we delve into these plugins, their benefits, and how to leverage them effectively to cater to the ever-growing demographic of digital-savvy banking students.

The digitization of banking

The transition to digital platforms has revolutionized the banking industry. This digitization has brought about a new era in banking where traditional, manual tasks are swiftly becoming obsolete.

Today, banking services are accessible on-demand, delivered through robust, secure web applications and mobile apps. These platforms serve as virtual banks, providing 24/7 access to account openings, transactions, and personal finance management services.

Gone are the days of waiting in line at a physical bank branch. Instead, students, a demographic heavily reliant on digital technology, can now take control of their finances at their convenience. This digitization offers unrivaled convenience and promotes efficiency and financial autonomy among student users. The shift towards digitization is an inevitability that banks must embrace to stay relevant and attract the tech-savvy student demographic.

Challenges in online student bank account opening

Despite the convenience digital banking presents, the transition is not without hurdles, especially for students opening bank accounts online. Issues may arise from technical complexities, security concerns, or simple unfamiliarity.

Navigating these challenges is crucial for both banks and students. By addressing these hitches, we can optimize this digital shift, enhance the student banking experience, and drive broader acceptance and usage of online banking. Let’s delve into these challenges and potential solutions.

Data security and privacy issues

The primary concern in online banking is data security and privacy. Digital platforms, while convenient, are susceptible to cyber-attacks. Online threats like identity theft and phishing pose significant risks. Students must protect their sensitive information, from personal details to transaction records.

On the other hand, banks must implement robust security measures to keep pace with evolving cyber threats. These measures should include regular system updates, secure encryption, and customer education on safe online banking practices.

Regulatory compliance complexities

Regulatory compliance in online banking is another significant challenge. Banks must strictly adhere to a complex web of laws and regulations. This ensures the legality of their operations and maintains customer trust.

Moreover, these regulations touch on multiple aspects of banking, such as customer data protection, fraud detection, and risk management. Students, as customers, must be aware of these regulations to understand their rights and responsibilities.

The task becomes more challenging with regulations constantly changing and evolving, requiring banks and customers to stay abreast of the latest developments.

Balancing user convenience and verification

Striking a balance between user convenience and verification is a critical challenge in online banking. Customers demand quick and smooth transactions, often at the expense of stringent security checks.

Conversely, while ensuring security, rigorous verification procedures may deter users due to their complexity. Banks must devise intuitive, user-friendly processes that do not compromise security. This strategy could involve leveraging biometric technologies or two-factor authentication. The goal is to establish a secure yet uncomplicated user experience, fostering trust and ease of use.

Catering to various levels of digital literacy

Online banking needs to account for varying levels of digital literacy among customers. Not everyone possesses the same comfort level with technology. Banks must ensure their online platforms are understandable, from tech-savvy millennials to older generations who may be less familiar with digital interfaces. This may involve creating easy-to-navigate interfaces, providing detailed instructions, or offering dedicated support for those struggling with the platform.

WordPress and banking: A synergetic relationship

Enter WordPress, a powerful tool that can easily navigate these banking complexities. This content management system, known for its simplicity and versatility, can significantly enhance online banking experiences.

By offering customizable interfaces and accessibility features, WordPress can help banks create user-friendly digital platforms, irrespective of a user’s technological prowess.

In the following sections, we will explore deeper into how WordPress and banking create a synergistic relationship that can overcome the challenges of online banking.

Why WordPress is ideal for online banking

WordPress is an ideal choice for online banking due to its inherent adaptability. This platform can accommodate a variety of functional plugins, aiding smooth banking operations. Its customizable nature ensures a user-centric design, essential for diverse digital literacy levels.

Moreover, WordPress offers robust security measures. Its frequent updates help safeguard against potential cyber threats, a critical aspect of banking.

Finally, with its easy-to-manage backend, banks can swiftly implement changes, ensuring an up-to-date experience.

Integration of banking services with WordPress platforms

Integrating banking services with WordPress platforms significantly elevates the user experience. Banks can leverage WordPress’s vast array of plugins for seamless transaction processing, account management, and personalized financial services.

Furthermore, WordPress compatibility with various banking APIs ensures data safety and real-time updates. This integration creates a comprehensive, secure, and convenient banking platform, fostering trust and user satisfaction.

Vital WordPress plugins for student accounts

As we dive deeper into WordPress and online banking, let’s explore an overlooked demographic: students. With distinct requirements and expectations, student banking presents its unique set of challenges.

Leveraging WordPress plugins, however, can transform these challenges into opportunities. Let’s explore how a selection of WordPress plugins can enhance the online banking experience for student accounts.

Read on, and let’s examine some notable plugins in detail.

WP Forms: Customizable forms for account applications

WP Forms allow students to open a student bank account online quickly. This customizable forms plugin simplifies the application process, eliminating unnecessary paperwork. Students can fill in their details and submit their application digitally.

Furthermore, banks can tailor these forms to collect precise information, optimizing the account setup. This plugin’s user-friendly interface ensures students a smooth, hassle-free online banking experience.

MemberPress: Membership management for account holders

MemberPress revolutionizes account management for student account holders. This plugin lets banks categorize students into distinct membership levels enhancing personalized servicing. It’s convenient for students as it provides easy access to exclusive banking services.

Moreover, with MemberPress, students can manage their account preferences seamlessly, leading to a highly customized banking experience. The plugin also integrates easily with other WordPress tools, making it an ideal choice for student banking platforms.

Wordfence Security: Enhancing data security

Wordfence Security is a vital plugin for any online banking platform. It helps to safeguard sensitive student account data from potential cyber threats. With robust firewall protection and live traffic monitoring, it identifies and blocks harmful activities.

Furthermore, its malware scanner regularly checks for potential threats, ensuring high levels of data security. This provides peace of mind for students, knowing their banking information is protected.

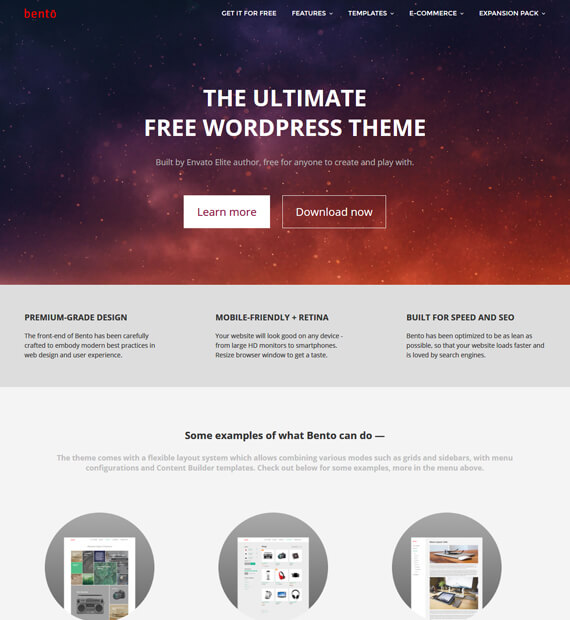

Bento: A flexible and free WordPress accounting theme

Bento is a free WordPress accounting theme that is ideal for startups. It offers high customization, ensuring a professional look for your website.

Despite being free, Bento doesn’t compromise on sophistication or power. It ensures a fully responsive design, adapting to all devices with ease. Bento simplifies the website creation process, making it an excellent choice for newcomers.

Avoiding common pitfalls in plugin integration

While plugin integration can skyrocket your online banking platform’s efficiency, the journey is often fraught with missteps. It’s crucial to navigate this process wisely to maximize benefits.

This section delves into common pitfalls institutions may encounter during plugin integration and the strategies to sidestep them. Creating a secure, user-friendly student banking portal can become a smoother endeavor with these insights.

Identifying and addressing typical challenges

One of the common challenges during plugin integration is compatibility issues. These can cause site crashes or unexpected behavior. Thorough testing before deployment can mitigate this risk.

Additionally, security vulnerabilities can arise from outdated plugins. Regular updates and routine security checks can ensure data protection.

Lastly, over-dependence on plugins can lead to a cluttered and slow platform. Keeping plugin usage to a minimum and only using essential ones can enhance site performance.

Proactive solutions and preventive strategies

Proactive solutions encompass a variety of strategies. Here’s what you can do to avoid potential headaches in the future:

- First, conduct routine plugin audits to assess the need for each one, removing any redundant plugins.

- Second, stay abreast of software updates to ensure optimal performance and security.

- Finally, consider using a staging site for testing plugins before integrating them into the live platform, reducing the risk of site crashes.

Revolutionizing student banking: The dawn of a new digital era

With the advent of the digital era, student banking is undergoing a transformative revolution. Financial institutions can offer students a robust, secure, and user-friendly banking platform by leveraging modern technologies and integrating strategic plugins. This improves the overall banking experience and instills financial literacy from a young age.

As we navigate the future of student banking, the potential for discovery and innovation remains vast. The key lies in continuous exploration, keeping up with emerging trends, and adapting swiftly to the evolving digital landscape. This pioneering approach paves the way for an exciting new phase in student banking, brimming with endless opportunities for growth and development.